- The Cashflow Cafe

- Posts

- US Elections & GL Implementation

US Elections & GL Implementation

What does Trump winning mean for Aussie businesses? Also what learnings does someone with 3+ GL implementations have for you in your ERP implementation?

This week, the pod dives into the ripple effects of the recent U.S. election and what it means for Australian businesses. From potential trade tensions to currency fluctuations, the pod unpacks the challenges and potential opportunities ahead.

Plus, if you’re planning a General Ledger system upgrade, Kevin shares his top five tips for a seamless ERP transition.

The U.S. Election's Impact on Aussie Businesses

One of the most significant potential outcomes of the U.S. election is a shift in tariff policies under the new administration. Kevin breaks this down into two scenarios:

Scenario 1: Blanket Tariffs on U.S. Imports

A blanket tariff (e.g., 5–10%) on U.S. imports could make Australian goods, like wine, beef, and manufactured products, less competitive in the U.S. market.

Australian exporters may need to explore new markets, such as Europe, to offset the potential loss of competitiveness.

While unlikely due to the strong Australia-U.S. trade relationship, this scenario highlights the importance of businesses diversifying their export strategies.

Scenario 2: Tariffs on Chinese Goods

If the U.S. imposes significant tariffs (e.g., 50–60%) on Chinese imports, the ripple effects could indirectly hit Australia.

China, Australia’s largest trading partner, could experience slower economic growth, reducing its demand for Australian commodities like coal, iron ore, and agricultural products.

This reduction in demand could lower export revenues, impact mining-dependent regions like Western Australia, and lead to job losses in export-focused industries.

Potential Alternate Scenario: Currency Volatility

The election's impact on global trade dynamics could lead to significant fluctuations in currency exchange rates. Kevin explains:

Strengthening U.S. Dollar: Pro-America policies may strengthen the U.S. dollar, which typically weakens the Australian dollar.

Opportunities: A weaker Australian dollar makes Aussie exports more competitive in international markets.

Challenges: Higher costs for imports, particularly essential goods and materials, could increase operating costs for businesses and contribute to inflationary pressures.

Inflation Risks: Australian businesses relying on imported goods may face rising costs, squeezing margins. These effects could further complicate the Reserve Bank of Australia’s efforts to manage inflation.

Foreign Investment: A weaker Australian dollar might attract foreign investors, but prolonged economic uncertainty could deter long-term commitments.

What This Means for Aussie Businesses

Businesses must assess their exposure to U.S. and Chinese markets and prepare contingency plans for potential trade disruptions.

Finance leaders should proactively discuss diversification strategies with their teams, identifying opportunities w/ alternative suppliers etc

Evaluate the proportion of revenue dependent on exports versus imports and adjust pricing strategies accordingly.

Top Tips for an ERP Rollout

Drawing from his recent experience, Kevin shares five golden rules for implementing a new financial system:

Leverage New Processes: Don’t replicate old habits; embrace best practices your new system offers.

Dedicate a Resource: Allocate a full-time finance lead to ensure the project is a priority.

Focus on Data: Build your system with data quality and reporting needs in mind.

Target Key Wins: Start with critical functions—cash flow, payroll, and accounts—before moving to phase two.

Set Up Controls: Establish strong controls from the start to avoid future headaches and ensure audit compliance.

Life Hack Of The Week

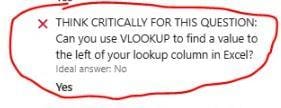

Bit of a buzz this week on Linkedin on a hiring hack. Linkedin has generic screening questions you can ask to weed out candidates.

We used this on a recent job ad, and >50% got this wrong by just clicking through responses on auto-pilot.

Is this something you could use when doing your own hiring?

The Cashflow Cafe is ‘the written version’ of our Podcast (The Ash, Hubert & Kevin Pod)

On our pod, we share finance stories, lessons, and mistakes to help business owners and finance pros understand sometimes complex concepts.

Our aim is for you to leave each episode thinking, "Ahk. I get it now."

Listen to our latest episode below, and like & subscribe on Youtube!

Liked this content? We release a weekly podcast & this newsletter, and would love for you to join the Cashflow Cafe Fam. Subscribe to this newsletter for bite sized accounting & finance gems in your inbox (to go with your choice of hot drink every morning).